Bank Statement Mortgage Loans

We at Turaco Mortgage are committed to enabling homeownership for all people, even those with unusual sources of income. We proudly provide bank statement mortgage loans that are adapted to your particular financial condition as a result.

With our mortgage option based on a 12-month bank statement, you can demonstrate your financial stability and get the house you want. Whether you’re considering refinancing with a bank statement mortgage or an FHA loan, our knowledgeable team is here to help you every step of the journey

We recognize that your financial situation involves more than just a paycheck’s worth of data. You can get the house of your dreams using our bank statement mortgage solutions to provide a thorough picture of your financial situation.

Are you prepared to start this thrilling journey? Together, let’s make your aspirations of becoming a homeowner a reality. Take the first step toward a better future by contacting us immediately to learn more about our bank statement mortgage services. We provide services in the following areas: Plantation, FL; Oakland Park, FL; Lauderdale Lakes, FL; Lauderhill, FL; and Tamarac, FL.

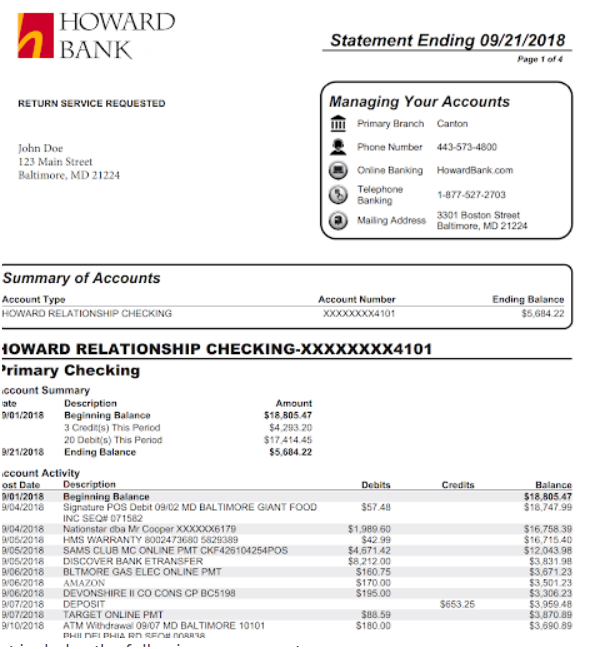

Bank Statement Loan

Bank Statement mortgage program is the perfect option for self-employed borrowers who need an alternative method to show the true cash flow of their business. Borrowers do not have to own 100% of the business.

- Loans up to $3 million with a minimum of $150,000

- 12 or 24 months business or personal bank statements

- 4 years seasoning for foreclosure, short sale, bankruptcy or deed-in-lieu

- Rates are 30-year fixed

- 2 years self-employed required

- Borrowers can own as little as 50% of the business for business bank statements and 25% for personal bank statements

- Purchase and cash-out or rate-term refinance

- Owner-occupied, 2nd homes, and non-owner occupied

- 1099 option available

- 40 year fixed interest only available

- Most loans will be qualified on an expense factor of 50%. Companies with a lower expense factor will require a statement from a third party CPA or tax preparer. (Some industries with traditionally higher expense factors will be underwritten with a 70% expense factor.)